The way credit scores are calculated is about to undergo a transformation. Fair Isaac Corp., the creator of the FICO model — the most widely used credit risk assessment tool in the United States — announced that it will begin including data from “buy now, pay later” (BNPL) loans in its next generation of credit scores, set to go into effect in the fall of 2025.

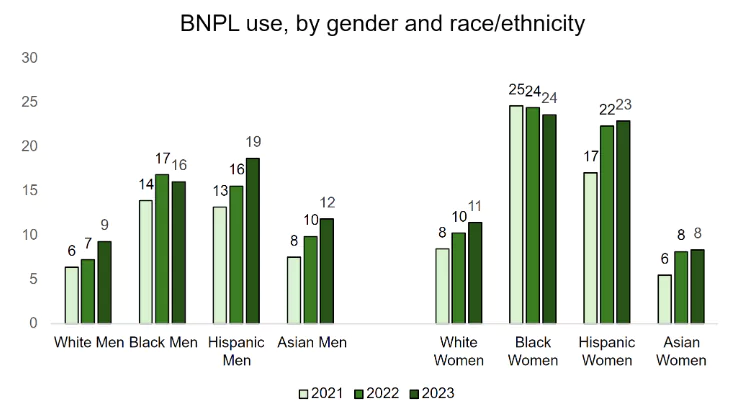

This change reflects a rapidly expanding reality: the growing use of BNPL services by American consumers for everyday purchases, such as groceries, clothing, and even electronics. According to the Federal Reserve, 14% of adults used some form of BNPL in 2023 — a significant increase from the 10% recorded two years earlier. The New York Fed estimates that one in five households has recently used this type of financing.

What’s Changing with the New FICO Version?

Until now, interest-free installment loans — typically paid in four payments — were excluded from traditional credit scoring models. Because these transactions are often not reported to credit bureaus (Experian, Equifax, and TransUnion), consumers who used them did not see a direct impact on their FICO scores.

That’s about to change with the introduction of FICO 10 and FICO 10T models. The “10T” version, in particular, brings an important innovation: it analyzes financial behavior over a 24-month period, capturing positive or negative debt trends. Now, with BNPL data included, the model will be better equipped to assess the risk profiles of consumers who use this type of credit.

According to Adam Rust, director of financial services at the Consumer Federation of America, this change will allow credit scoring models to capture so-called “phantom debt” — debt that a consumer already carries but that doesn’t appear in traditional credit reports. “If lenders can see this data, they’ll be able to better assess a borrower’s repayment capacity,” he said.

Who Stands to Benefit?

Credit experts generally welcome the inclusion of BNPL data in credit analyses, especially as it expands access to the financial system for those who don’t have credit cards or traditional loans.

“Not everyone wants a credit card or needs to finance a car. For these individuals, BNPL can serve as a legitimate bridge to building a credit history,” says Gerri Detweiler, a personal finance expert with over 30 years of experience in the industry.

Teresa Murray, from the U.S. Public Interest Research Group, goes further: “For those who pay on time, this history can be a gateway to other financial products, such as mortgages and credit lines.”

Will Lenders Adopt the New Model?

It’s too soon to say. Although 90% of U.S. lenders use some version of the FICO model, many still operate with older versions, such as FICO 8. Much like with smartphone updates, many banks and financial institutions take years to adopt new versions.

Organizations like Fannie Mae and Freddie Mac, which operate in real estate financing, planned to adopt FICO 10 in 2025, but implementation has been delayed. When that happens, it could provide a major boost to widespread adoption, analysts say.

Moreover, for BNPL data to influence your score, providers must report it to credit bureaus — and that’s still not mandatory. Affirm, for example, already shares information with Experian and TransUnion. Klarna reports data from its long-term loans. Afterpay, however, is still waiting for more evidence to show that sharing BNPL data won’t harm consumers.

Will This Affect Your Score?

The most accurate answer is: it depends. For those who don’t use BNPL, there will be no impact — the “credit mix” accounts for just 10% of the overall score. But for those who use this model frequently, a positive payment history could help boost their score — provided payments are made on time and properly reported.

However, the risk lies in accumulating silent debts. A Fed study warns that excessive BNPL use can lead to increased spending, overdraft fees, and credit card debt.

“Many small payments can quickly add up to a big problem,” warns Michelle Singletary, personal finance columnist at The Washington Post. “The best way to protect your score is to keep paying your bills on time and stay on top of your budget.”

What Should You Do Now?

Despite the changes, the fundamentals of maintaining a good credit score remain the same: pay on time, avoid unnecessary debt, and build a positive credit history. For those already using BNPL responsibly, this FICO update may open new doors in the financial system.

And if you’re concerned about debt or need guidance, seek help from reliable organizations such as the National Foundation for Credit Counseling (nfcc.org).

In the end, this change represents another step in modernizing the American credit system, aligning it more closely with current consumer habits — and potentially making it fairer and more accessible for millions of people.