The credit card market is becoming increasingly competitive, with options ranging from basic no-annual-fee models to luxurious premium cards that offer exclusive benefits at high prices.

In this scenario, the Citi Strata Premier Card emerges as an intermediate alternative, designed for consumers who want to enjoy robust rewards and travel protections without facing the elevated costs of elite cards.

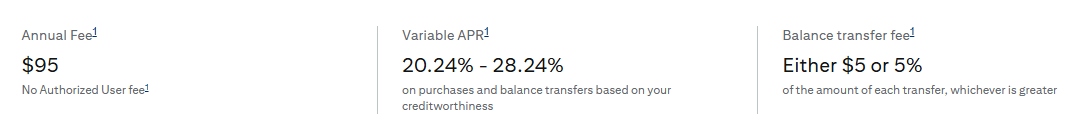

With an annual fee of $95, the Strata Premier promises to be a versatile ally both for everyday use and for travel experiences.

Rewards structure: generosity in everyday life

The main differentiator of the Strata Premier lies in its rewards structure. The card earns ThankYou points, Citi’s own system that has become known for its flexibility and the possibility of transferring to airline and hotel partners.

Cardholders can earn 10 points per dollar spent on hotels, car rentals, and attractions booked through CitiTravel.com, plus 3 points per dollar on airfare, restaurants, supermarkets, gas stations, and even EV charging stations. For all other purchases, each dollar equals one point.

The welcome offer is also generous: 60,000 points for new users who spend $4,000 in the first three months of use. This bonus can be converted into about $600 in travel credits or gift cards, a benefit that puts the card in a competitive position against rivals in the same price range.

The hotel benefit: an opportunity with restrictions

In addition to the points structure, the Strata Premier offers an annual $100 credit on hotel stays, valid for bookings of at least $500, excluding taxes and fees, made through Citi Travel.

Although it is a relevant advantage for frequent travelers, this benefit may be seen as limited for those traveling on a tighter budget or who prefer shorter stays.

Still, for those who travel at least once a year, the credit helps offset the annual fee and reinforces the card’s added value.

Travel and purchase protections

Another important pillar of the Citi Strata Premier is the protections offered. The card includes coverage for travel delays and cancellations, insurance for lost or damaged luggage, as well as rental car protection. These benefits bring peace of mind in unexpected situations and are differentiators that, in practice, can prevent significant extra costs.

A relevant detail is the absence of foreign transaction fees. For those who travel abroad frequently or even for those living outside the United States, this feature makes the card even more attractive, as it eliminates a common expense in purchases made in foreign currency.

Comparing with direct competitors

When analyzing the Citi Strata Premier in relation to other cards in a similar range, such as the Chase Sapphire Preferred and the Capital One Venture Rewards, it becomes clear that Citi’s proposal is to deliver a diversity of benefits.

| Feature | Citi Strata Premier® | Chase Sapphire Preferred® | Capital One Venture Rewards® |

| Annual Fee | $95 | $95 | $95 |

| Welcome Bonus | 60,000 points (≈ $600) | 60,000 points (≈ $750) | 75,000 miles (≈ $750) |

| Travel Rewards | Up to 10x via Citi Travel | Up to 5x via Chase Travel | 2x on all purchases |

| Dining Rewards | 3x | 3x | 2x |

| Additional Benefit | Annual $100 hotel credit | Advanced travel protection | Simplicity and flexibility |

While the Chase Sapphire Preferred offers greater value on point redemptions through the Chase portal and the Capital One Venture Rewards focuses on the simplicity of 2x points on all purchases, the Citi Strata Premier stands out by offering higher earning rates across diverse categories, balancing everyday life with travel.

Who is this card best for?

The Citi Strata Premier is designed for consumers seeking a balance between cost and benefit. It serves travelers well who want flexibility but do not wish to pay the heavy annual fees of premium cards. It is also a good option for those who spend significantly on groceries, restaurants, and travel, as these categories provide above-average returns.

On the other hand, it is not the best choice for those who rarely travel or do not intend to take advantage of the annual hotel benefit, as part of the added value may be lost in such cases. For consumers who prioritize maximum simplicity, the Capital One Venture Rewards may still be the more practical option.

Conclusion: a strategic option in the market

The Citi Strata Premier Card positions itself as one of the most complete cards in its price range. It does not compete with the giants of the luxury segment, but it delivers an intelligent combination of benefits, generous rewards, and robust travel protections.

With an affordable annual fee and a flexible points system, the card consolidates itself as a strategic choice for consumers who want to turn everyday spending into real travel opportunities and experiences.

In a market saturated with promises, the Citi Strata Premier proves that it is possible to offer real value with simplicity, without giving up the sophistication that modern travelers seek.