Imagine having the opportunity to rebuild your financial reputation with a card that doesn’t require a security deposit, comes from a prestigious brand like American Express, and might even be a bridge to other company products in the future.

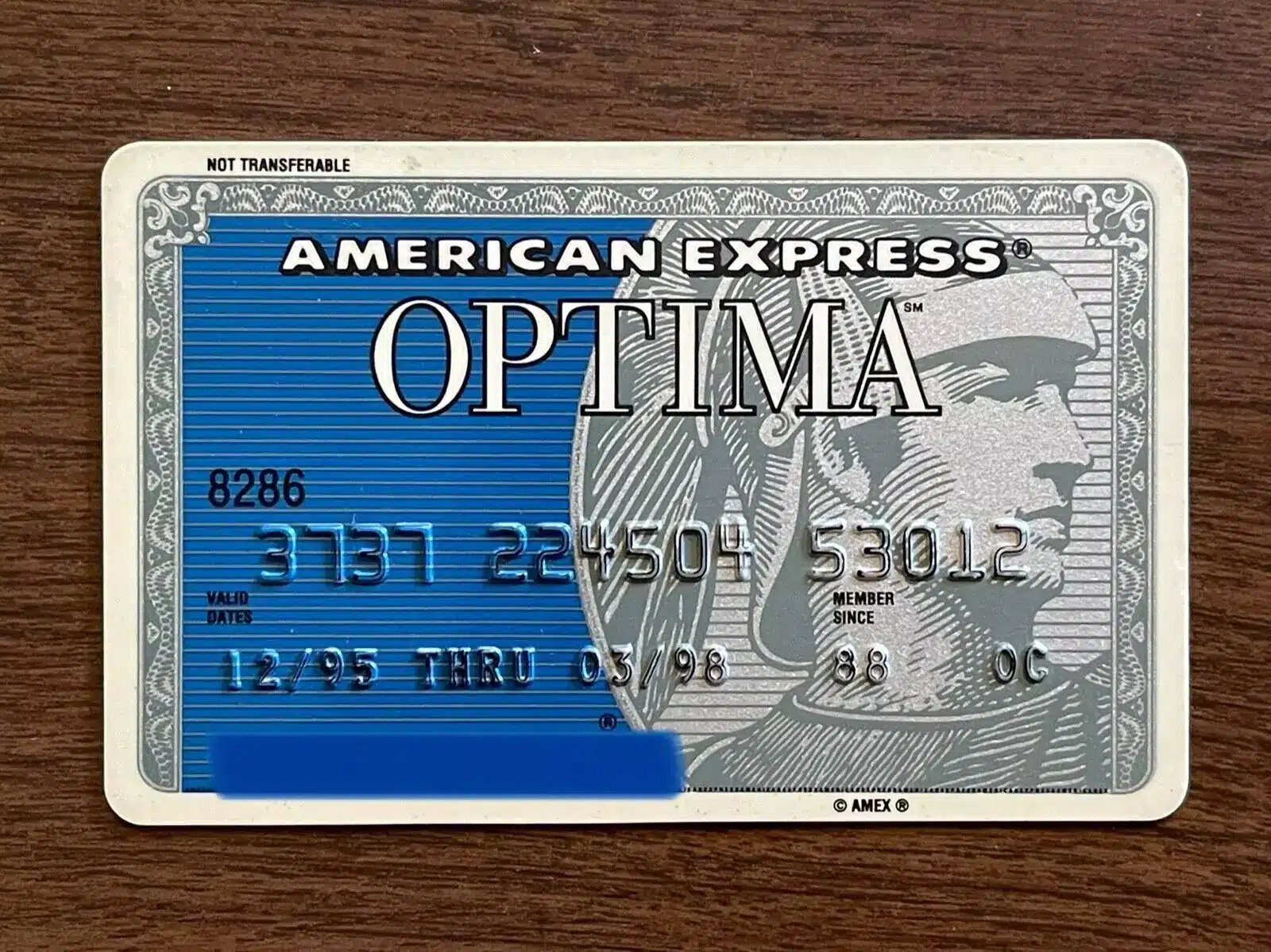

Finding your way back to credit after financial difficulties can seem challenging, but the American Express Optima emerges as an exclusive—and even mysterious—option in these situations. Offered by invitation only, this card doesn’t appear on mainstream platforms, but it can be an important step for those looking to regain financial stability with more responsibility.

What is the American Express Optima?

The Amex Optima is a card geared toward people who have previously had an account with American Express and, for some reason, fell into default but paid off their debt to the company. It serves as a fresh start. Unlike traditional cards with rewards and miles, the Optima doesn’t offer extravagant perks—its main mission is credit rebuilding.

It carries an annual fee of $49, which makes it more affordable compared to other credit cards, especially those designed for people with low credit scores or who have recently come out of bankruptcy.

A fresh start with no security deposit

One of the most notable advantages of this card is that, unlike most credit-rebuilding cards, the Amex Optima doesn’t require a security deposit. This is a significant benefit, considering that many options require users to deposit between $200 and $500 as collateral.

Additionally, there are no account opening or maintenance fees, which makes the experience smoother for those starting over.

Limitations you need to consider

Before making a decision, we need to address a few points. Despite its advantages, the Optima has important restrictions. It cannot be applied for freely: it is only offered by invitation from American Express, and only after a previous debt has been settled. This means it’s not accessible to the general public, and even for former Amex customers, there’s no guarantee the invitation will come.

Another concern is the high penalty APR. In the event of late or returned payments, the applied interest rates are high and remain active for at least six months, even if the customer resumes timely payments.

| Feature / Card | American Express Optima® | Super.comSecured Card | Discover it® Secured | Chime Credit Builder Visa® |

| Target Audience | Former Amex customers rebuilding credit | Anyone needing to build/rebuild credit | Beginners with available deposit | Those who want flexibility and no deposit |

| Credit Check Required | Yes | No | Yes | No |

| Security Deposit Required | No | No (prepaid style) | Yes (minimum $200) | No |

| Annual Fee | $49 | $0 | $0 | $0 |

| Rewards | None | 1% cashback on all purchases | 2% on gas/restaurants; 1% elsewhere | None |

| Credit Reporting | Yes (3 bureaus) | Yes (3 bureaus) | Yes (3 bureaus) | Yes (3 bureaus) |

| International Use | Limited | U.S. & Canada only | Yes | No |

| Penalty APR | High (applies after late payments) | None | High (27.24% variable) | None |

| Upgrade Possibility | Possible after responsible use | No upgrade – prepaid style | Automatic review from 7 months | No limit, no traditional upgrade |

| Ideal For | Rebuilding after Amex settlement | People with no credit history | Those wanting cashback + rebuild | People who want control/flexibility |

How does Optima compare to other cards?

There are other options on the market that also aim to help rebuild credit—some even offer additional benefits like cashback or points programs.

The Discover it Secured card, for example, offers 1% to 2% cashback, and matches the total amount earned at the end of the first year. The downside is that it requires an initial $200 deposit, although that amount may be refunded over time.

Chime Credit Builder, on the other hand, is a modern and flexible alternative. It doesn’t require a fixed deposit or credit check, and the usage limit is based on the amount the user transfers from a linked checking account.

For those seeking a more traditional route, the Secured Card may function as a hybrid between a credit card and a prepaid card, with a minimum 1% cashback and no annual fee.

Who should consider the Amex Optima?

This card is ideal for those who had a relationship with Amex, defaulted, but managed to pay off the balance through a settlement. The Optima serves as a gateway to regain the company’s trust and, eventually, receive invitations to more advantageous Amex cards.

On the other hand, it is not recommended for those looking for rewards or miles or for someone needing a card with broad international acceptance. The American Express network still has limitations outside the U.S., especially in small businesses and for international travel.

Is it really worth it?

If you received an invitation from Amex after settling your debt and you’re looking to rebuild your credit responsibly, Optima can be an opportunity. But it’s essential to understand the terms carefully, especially regarding interest rates and the lack of rewards.

For those still searching for a credit card to start rebuilding their score, it might be more interesting to consider more flexible alternatives, such as Chime or Discover cards, which offer more autonomy and transparency in the journey.

Practical tips to rebuild your credit with Amex Optima (or any other card)

Always pay on time

Punctuality is the most important factor in rebuilding credit. Set alerts on your phone or enable auto-pay to avoid missing payments.

Use only a portion of your available limit

Avoid spending more than 30% of your total limit. This shows financial control and helps maintain (or improve) your credit score.

Avoid carrying balances

Even with a card that allows you to pay in installments or just the minimum, avoid rolling over balances. Interest rates—especially on the Optima—can be quite high.

Monitor your credit score regularly

You can track your progress using apps like Credit Karma, Experian, or Amex’s own dashboard if available.

Be patient and consistent

Rebuilding credit takes time. The key is to show responsible behavior month after month. Many Optima users report receiving new Amex offers after one year of positive credit history.