U.S. foreign trade, often described as the invisible engine of the economy, is going through a period of ups and downs that clearly illustrates the complexity of the global scenario. After months of contraction caused by a wave of tariffs imposed by the Trump administration, data from the Department of Commerce brought brief relief: imports grew 5.9% and exports rose 0.3% compared to the previous month.

Seemingly modest, this movement is revealing. It shows that despite tariff turbulence, consumers and companies continue to demand foreign products, especially gold, computer chips, and equipment aimed at artificial intelligence infrastructure—sectors that symbolize both the search for security and the global technological race.

The Deficit That Doesn’t Let Up

With imports growing faster than exports, the U.S. trade deficit also widened: $78.3 billion in July, a jump of 32.5%. The surge was driven by gold purchases, in anticipation of tariffs on Swiss products, and by resilient demand for semiconductors and high-performance computers.

The deficit with Switzerland increased by $7.6 billion, while the deficit with China rose by $5.3 billion. However, on an annual basis, American imports from China fell by about one-third in the second quarter, evidence that the trade dispute has been reshaping global flows.

Cars and pharmaceuticals, on the other hand, saw declines. The first, due to 25% tariffs on foreign vehicles; the second, after months of heavy preventive stocking against new taxes.

The Role of Gold and Artificial Intelligence

For Matthew Martin, economist at Oxford Economics, more than half of the import increase was due to the rush for gold, a traditional safe haven in times of uncertainty. But there is another force at play: artificial intelligence.

Data centers, computers, and semiconductors continue to be imported on a large scale. “AI-related supply chains show resilience because they represent the country’s competitive future,” said Martin. This dynamic reveals that even amid tariff barriers, strategic sectors manage to escape severe contractions.

| Category | Value (July 2025) | Variation / Highlights |

| Total Imports | $358.8 billion | Up 5.9% from June (Reuters) |

| Total Exports | $280.5 billion | Modest increase of 0.3% (Reuters) |

| Trade Deficit (goods + services) | $78.3 billion | Growth of 32.5%, reflecting the surge in imports (Reuters) |

| Goods Trade Deficit | $103.9 billion | Increase of 22–21%, according to estimates, impacted by imports of industrial supplies and capital goods (MarketWatch, Reuters) |

| Gold Imports (non-monetary) | Increase of $12.5 billion | Part of industrial supplies; reflects advance purchases due to tariffs (Reuters) |

| Capital Goods Imports (e.g., IT, telecom, machinery) | Record $96.2 billion | Strong growth, indicating resilience in tech demand (Reuters) |

| Imports of Vehicles and Semiconductors | Declines recorded | Motor vehicles and semiconductors fell, possibly due to tariffs (Reuters) |

The Weight of Tariffs

Still, the effects of tariff measures are felt unevenly. In August, even harsher tariffs came into effect, raising import taxes to between 10% and 50% on dozens of countries.

Southeast Asia, seen as an alternative to escape dependence on China, was hit hard: Taiwan, Malaysia, Cambodia, and Thailand face 20% tariffs on their products. India, once considered a safe destination for manufacturers, was surprised with a 50% tariff.

In addition, Trump announced plans to tax goods produced in third countries that use Chinese raw materials or parts—the so-called “transshipment.” This particularly affects Asian economies highly integrated into China’s production chains.

Impacts on Consumers and Companies

Economists note that tariffs function as an additional tax. Trump argues that cheap foreign products have cost American industry jobs and that the surcharge is a way to “level the playing field.”

But costs are passed along. “At this moment, businesses and consumers are paying the tariffs instead of avoiding imports,” observed Brad Setser of the Council on Foreign Relations.

This pressure is already visible on store shelves and in energy bills, given the increased consumption by data centers. Families feel the impact on consumer goods, while industries that depend on foreign inputs face higher costs.

Between Deficits and Boycotts

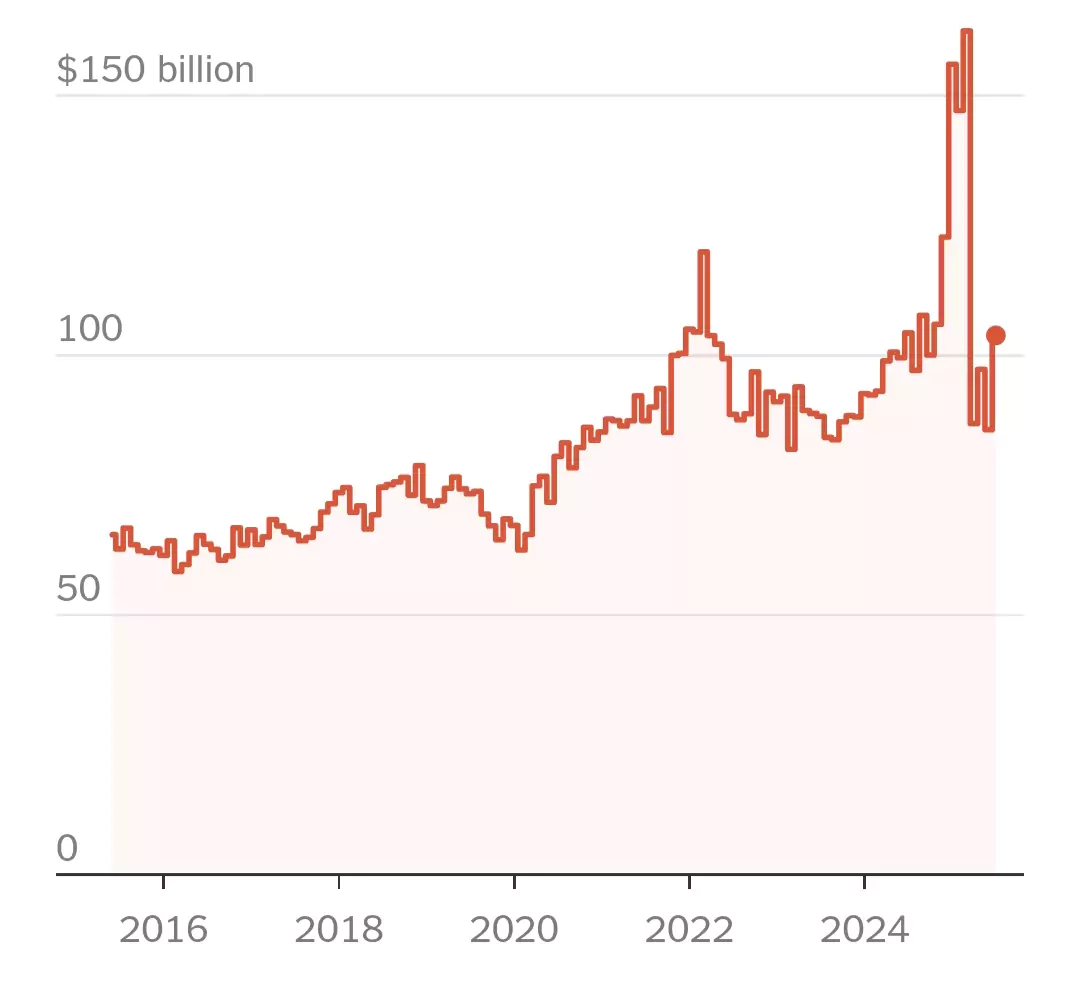

The trade deficit is a central political flag for Trump, who even described it as a “national emergency.” In 2023, it hit a record $1.2 trillion. And although at times it has declined, analysts point out that this was due less to structural gains and more to the initial shock of tariffs.

There is also the risk of retaliation. Canada is already testing boycotts on American wines and bourbons, while China suspended soybean purchases. This reverse effect could erode exports and further widen the deficit.

Mark Zandi, chief economist at Moody’s Analytics, sums it up: “There is no indication that higher tariffs result in a significantly smaller deficit. At most, we see temporary swings, but the trend remains.”

A Market in Reorganization

Behind the volatility, a larger process is underway: the reorganization of global supply chains. American companies have diversified suppliers, shifting part of production to Southeast Asia, but now face new tariff barriers.

The resilience of U.S. domestic consumption, however, has sustained trade, albeit at a higher cost.

The challenge is knowing for how long. The economy shows signs of strength but also of vulnerability. If harsher tariffs persist, companies and consumers may rethink habits, and the very position of the U.S. in global trade could be called into question.