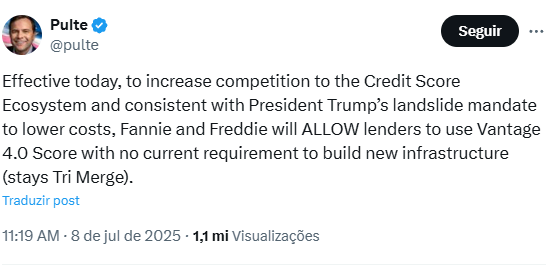

In the U.S. financial landscape, a quiet yet potentially transformative change is underway: mortgage lenders will now be able to choose between two different credit scores to evaluate borrowers. The traditional FICO Score, widely used for decades, now has a new counterpart — the VantageScore, a model developed by the three major credit agencies: Equifax, Experian, and TransUnion. The decision was announced on July 8 via the social network X by William Pulte, director of the Federal Housing Finance Agency (FHFA), which oversees Fannie Mae and Freddie Mac.

The measure aims to increase competition and broaden access to mortgage credit. For millions of Americans who traditionally face barriers when trying to obtain a mortgage, this could represent a real opportunity to purchase a home.

Why is the credit score so important?

Credit scores are one of the main tools used by lenders to assess a borrower’s risk. They directly influence the interest rate offered and can result in thousands of dollars in savings (or costs) over the life of a mortgage.

The classic FICO model, created by the Fair Isaac Corporation, is used in 90% of credit decisions. However, industry experts have highlighted the advantages of VantageScore, especially for those with limited credit history or non-traditional financial data.

What changes with VantageScore?

The VantageScore 4.0 model promises to be more inclusive. It considers, for instance, rent payment history, cell phone bills, and utility payments — information that does not carry significant weight in the classic FICO model. As a result, an estimated 5 million more people could be considered eligible for mortgages, according to data from VantageScore itself.

This model is particularly beneficial for young adults or consumers newly introduced to the financial system. As explained by Guy Cecala, CEO of Inside Mortgage Finance, VantageScore places greater weight on on-time payments, which can benefit individuals without an extensive credit history.

Adoption and practical challenges

Despite the immediate authorization for Fannie and Freddie to use VantageScore, implementation will not be automatic. Lenders will need to adapt their systems and processes, which could take months or even up to a year. According to analyst Jaret Seiberg of TD Cowen, it’s likely that some banks will acquire both scores (FICO and Vantage) to ensure better rates for their customers — a move that could pressure the development of increasingly “generous” models toward borrowers.

Differences between the two models

Both FICO and VantageScore use a scale ranging from 300 to 850 points. However, their methodologies differ. VantageScore tends to be more flexible, allowing consumers with alternative financial data (such as rental payments) to build a score. In contrast, the classic FICO model is more conservative, potentially excluding many would-be borrowers.

| Criteria | FICO Score (Classic) | VantageScore 4.0 |

| Score Range | 300 to 850 | 300 to 850 |

| Year Created | 1980s | 2006 |

| Developed By | Fair Isaac Corporation (FICO) | Equifax, Experian, and TransUnion |

| Market Usage | Used in about 90% of credit decisions | Increasing adoption, especially by fintechs and alternative lenders |

| Minimum Credit History | At least 6 months of credit history | Can generate a score with just 1 month of history and 1 active account |

| Primary Focus | Traditional credit history | Includes alternative data like rent, cell phone, and utility payments |

| Sensitivity to Late Payments | Very sensitive to recent late payments | Also sensitive, but with slightly more tolerance |

| Alternative Data Inclusion | Limited, except in newer versions (e.g., FICO 10 T) | More inclusive, considers rent, bills, and utility payments |

| Data Update Frequency | Depends on each credit bureau’s reporting | Often updated more frequently, reflecting changes faster |

| Accepted by Fannie/Freddie | Yes, classic version still the standard | Recently approved, starting to be accepted by lenders |

The Fair Isaac Corporation, which created FICO, has also launched a more modern version — FICO 10 T — that includes data such as rent and utility payments. However, Fannie and Freddie have not yet adopted this model.

Risks and considerations

While some experts celebrate the inclusion of VantageScore as a way to democratize access to housing, others raise concerns. Will Lansing, CEO of Fair Isaac, warns of the risk of a “race to higher scores,” in which companies might loosen their criteria to appeal to lenders. Additionally, Chi Chi Wu of the National Consumer Law Center questions whether genuine competition will occur, given that VantageScore is controlled by the same agencies that supply the data used to generate FICO scores.

What can consumers do?

For those planning to finance a home, the recommendation is simple: monitor your credit report closely. It can be accessed for free at www.annualcreditreport.com. Paying bills on time, keeping credit card usage low, and avoiding opening multiple credit accounts in a short time frame remain the best practices.

But don’t forget: shopping around for mortgage options is key. According to Freddie Mac, comparing at least four loan offers can save up to $1,200 per year.

The mortgage credit landscape is evolving. The inclusion of VantageScore may be the first step toward a more inclusive system tailored to the financial realities of millions of Americans.